HDB Minimum Occupation Period Explained – What Happens After MOP Ends

Reaching the Minimum Occupation Period (MOP) is a major milestone for any HDB homeowner. The MOP, typically five years for most Build-To-Order and resale flats, was designed to ensure that public housing serves its core purpose of providing homes, rather than becoming a quick investment vehicle. For some categories, such as Prime Location Housing (PLH) flats, the MOP is ten years, while special schemes like the Fresh Start Housing Scheme can extend to twenty years.

Once this minimum period is fulfilled, homeowners gain far greater flexibility. Restrictions that previously limited selling, renting out the flat in full, or purchasing private property are lifted for most cases. This milestone marks a turning point where you can decide if it is time to sell, generate rental income, or start exploring private property options. The decision you make will shape the next stage of your property journey.

What the End of MOP Means

Greater Flexibility

When the MOP ends, the key restrictions on your HDB are removed. You can now sell your flat on the open market, lease out the entire unit, or retain it while buying a private property. This opens doors to wealth-building strategies that were previously off-limits.

Flat-Type Differences

Not all HDB flats enjoy identical flexibility. For example, PLH flats continue to face restrictions even after their longer 10-year MOP – owners cannot rent out the entire unit at any point. Executive Condominiums also follow unique rules: new ECs carry a 5-year MOP, while resale ECs are not subject to MOP rules, though eligibility conditions still apply depending on the buyer profile. Understanding these distinctions ensures you don’t make plans that may later be restricted by policy.

HDB MOP Rules for BTO, Resale Flats, ECs and More

The duration of the MOP depends on the type of flat and the scheme under which it was purchased. Most new flats, including Build-To-Order (BTO), Executive Condominiums (ECs), and Design, Build and Sell Scheme (DBSS) flats, require owners to fulfil a 5-year MOP. PLH flats have the longest duration at 10 years, reflecting their prime central locations. For resale flats purchased on or after 30 August 2010, the MOP is also 5 years. Flats acquired under the Selective En bloc Redevelopment Scheme (SERS) carry a fresh MOP of 5 years from the date keys are issued. Households under the Fresh Start Housing Scheme face a 20-year MOP, the strictest requirement, to ensure stability for families given a second chance at home ownership.

For ECs, the rules are unique. Owners of new ECs must meet a 5-year MOP before they can sell to Singapore Citizens or Permanent Residents. After 10 years, ECs are fully privatised and may then be sold to foreign buyers. Resale ECs, however, are not subject to MOP rules.

Why is HDB MOP so important in Singapore?

The MOP plays a vital role in maintaining the integrity of public housing. It prevents speculative behaviour and ensures that flats serve as homes rather than quick-profit assets. Without the MOP, there would be greater risk of buyers treating HDB flats as investment opportunities, flipping them in a short span and driving up resale prices. This could have made public housing unaffordable for many Singaporeans.

The introduction of the PLH model further highlights the importance of the MOP. By extending the period to 10 years and imposing stricter rules such as disallowing full-flat rentals, the government reinforces the principle that public housing, especially in prime districts, must remain accessible and affordable for genuine owner-occupiers rather than investors.

HDB MOP Exceptions

Although most homeowners must complete their MOP, there are specific situations where exceptions are granted. These are assessed on a case-by-case basis. For example, in cases of divorce, owners may be allowed to sell before fulfilling the MOP. Bankruptcy or financial hardship, such as the inability to service the mortgage due to death, disability, or loss of income, may also qualify. Other scenarios include terminal illness or permanent relocation overseas, including cases involving the renouncement of citizenship.

In such cases, HDB may permit an early sale to provide financial relief or accommodate significant changes in personal circumstances. However, approvals are not guaranteed and depend heavily on documentation and individual assessments. These exceptions underline the balance between policy enforcement and compassion for genuine hardship cases.

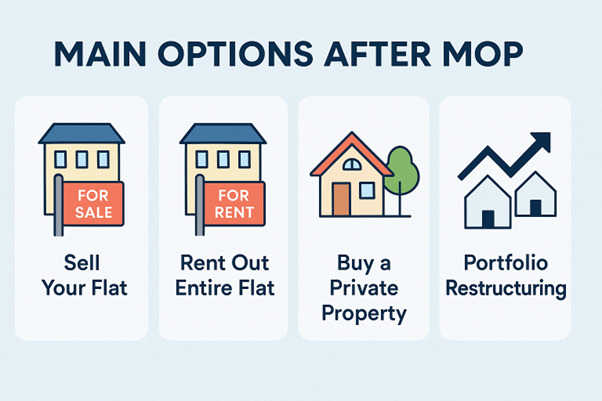

Main Options After MOP

Sell Your Flat

Selling allows you to realise the equity built up in your home. The resale value depends on factors like location, remaining lease, and condition of the flat. Policies such as the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) quotas may also affect buyer eligibility. A professional valuation helps you set the right price and market the unit effectively.

Rent Out Entire Flat

Another path is to lease your flat for rental income. This can provide a consistent cash flow, particularly in estates with high demand from tenants, such as areas near MRT stations or business districts. Do note that owners of PLH flats are not permitted to rent out the whole unit, even after completing the MOP.

Buy a Private Property

You may choose to retain your HDB while purchasing a private property. While attractive, this option requires careful planning. Costs like Additional Buyer’s Stamp Duty (ABSD), loan-to-value (LTV) limits, Total Debt Servicing Ratio (TDSR), and CPF withdrawal caps must be considered. Misjudging these factors could strain cash flow or limit future opportunities.

Portfolio Restructuring

For families with higher incomes, restructuring strategies such as upgrading to a condominium or pursuing a “sell one, buy two” approach can diversify holdings. In the latter, each spouse owns a separate property, reducing ABSD exposure. However, this strategy requires strong income stability, as it involves managing two mortgages under TDSR rules. It is best undertaken with professional financial planning.

Practical Considerations

Checking Your MOP Status

Confirming your eligibility is the first step before making any move. This can be done through My HDBPage using Singpass, under “Purchased Flat” → “Flat Details” → “Minimum Occupation Period.” This ensures you do not accidentally commit to a sale or rental prematurely.

Timing the Market

Beyond eligibility, the timing of your decision is crucial. Resale prices and rental yields are influenced by demand, government measures, and broader economic conditions. Entering the market at the right time can significantly improve your returns.

Aligning with Long-Term Goals

Each option after MOP should be measured against your long-term financial and lifestyle objectives. Considerations include future housing needs, retirement planning, and the ability to service new mortgage obligations. Making decisions in line with these goals ensures sustainable growth and avoids unnecessary financial stress.

Conclusion

Completing your HDB flat’s MOP is a significant milestone that brings new choices to the table. From selling and upgrading, to renting for steady income, or branching into private property ownership, each path offers unique benefits. The right decision depends on your financial readiness, lifestyle needs, and long-term plans.

While some strategies may appear attractive, such as retaining your HDB while purchasing private property or attempting portfolio diversification, they also carry additional responsibilities and risks. Clear understanding of policies, financial limits, and personal objectives is essential.

Whichever route you choose, this turning point gives you the chance to shape your property journey and secure your next chapter in Singapore’s ever-evolving housing landscape.

FAQ’s

1. How is the MOP calculated?

The MOP is counted from the date you collect the keys to your flat, not the application date. Periods when you are not physically occupying the flat, such as extended stays overseas, do not count towards the MOP.

2. Can I sell my HDB flat before the MOP ends?

Generally, no. However, exceptions may be granted in special cases such as divorce, bankruptcy, terminal illness, or financial hardship. Each case is assessed individually by HDB.

3. Can I buy a condominium before my MOP is up?

You cannot buy private residential property until you have completed your MOP. This rule prevents homeowners from treating subsidised housing as a stepping stone for quick investments.

4. Are all flat types subject to the same MOP rules?

No. Most BTO and resale flats have a 5-year MOP, while PLH flats have 10 years. Special schemes like Fresh Start Housing require 20 years. New ECs have a 5-year MOP, while resale ECs are not bound by MOP rules.

5. Can I rent out rooms during the MOP?

Yes. While renting out the entire flat is not allowed during the MOP, you are permitted to rent out individual rooms provided you continue to live in the flat and comply with HDB’s rental regulations.